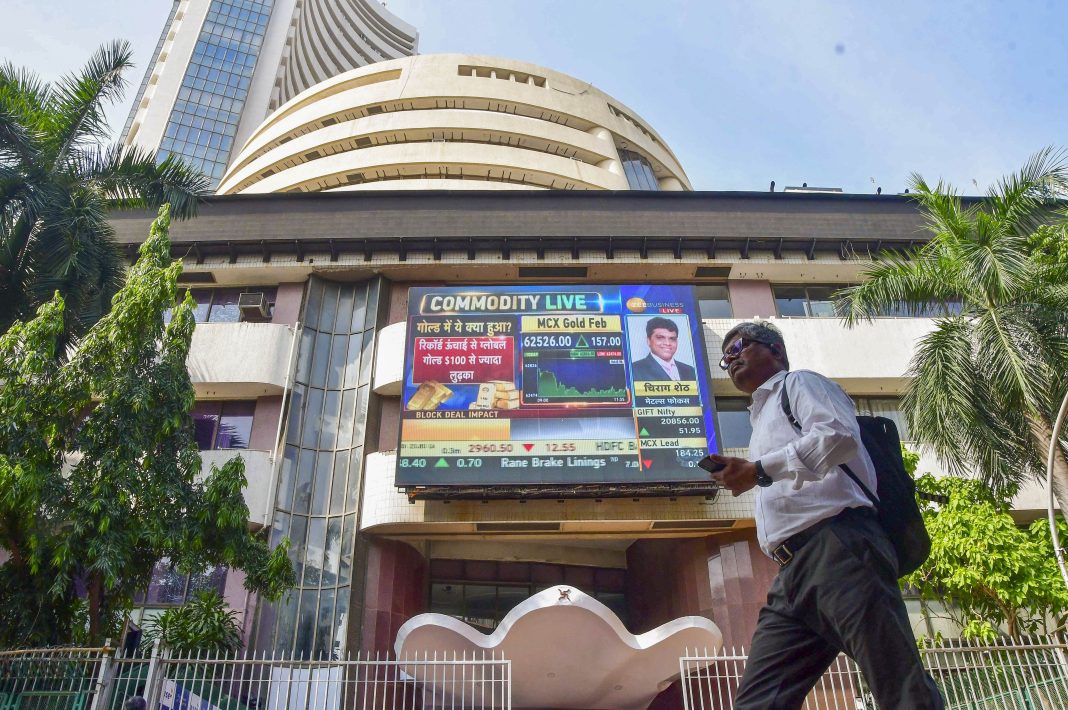

Mumbai, Nov 7: Benchmark equity indices Sensex and Nifty fell in early trade on Thursday after two days of rally as investors remained on the sidelines ahead of the US Federal Reserve interest rate decision.

Market analysts said unabated foreign fund outflows and mixed global cues further dented investor sentiments.

The BSE Sensex declined 237.93 points to 80,140.20 in early trade. The NSE Nifty dropped 109.1 points to 24,374.95.

From the 30-share Sensex pack, Bajaj Finserv, UltraTech Cement, Power Grid, ICICI Bank, Bajaj Finance, Kotak Mahindra Bank, Adani Ports and Nestle were among the biggest laggards.

Tata Steel climbed over 1 per cent after the firm reported a net profit of Rs 758.84 crore for the September 2024 quarter.

HCL Technologies, Tata Consultancy Services and JSW Steel were also the gainers from the pack.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 4,445.59 crore on Wednesday, according to exchange data.

In Asian markets, Seoul, Shanghai and Hong Kong traded higher while Tokyo quoted lower.

Wall Street ended significantly higher on Wednesday.

“In overnight trade, Wall Street hit record highs, driven by optimism surrounding Trump’s presidency and hopes for increased fiscal spending and tax cuts to boost growth,” Prashanth Tapse, Senior VP (Research) at Mehta Equities Ltd, said.

Republican leader Donald Trump won the US presidential election for a second term, handing a shock defeat to his Democratic rival Kamala Harris, in one of the most remarkable comebacks in American electoral history, by rising from the political wilderness four years after his eviction from the White House and subsequent failed attempt to overturn the 2020 election outcome.

Global oil benchmark Brent crude climbed 0.92 per cent to USD 75.61 a barrel.

The BSE benchmark jumped 901.50 points or 1.13 per cent to settle at 80,378.13 on Wednesday. The Nifty soared 270.75 points or 1.12 per cent to 24,484.05. (PTI)