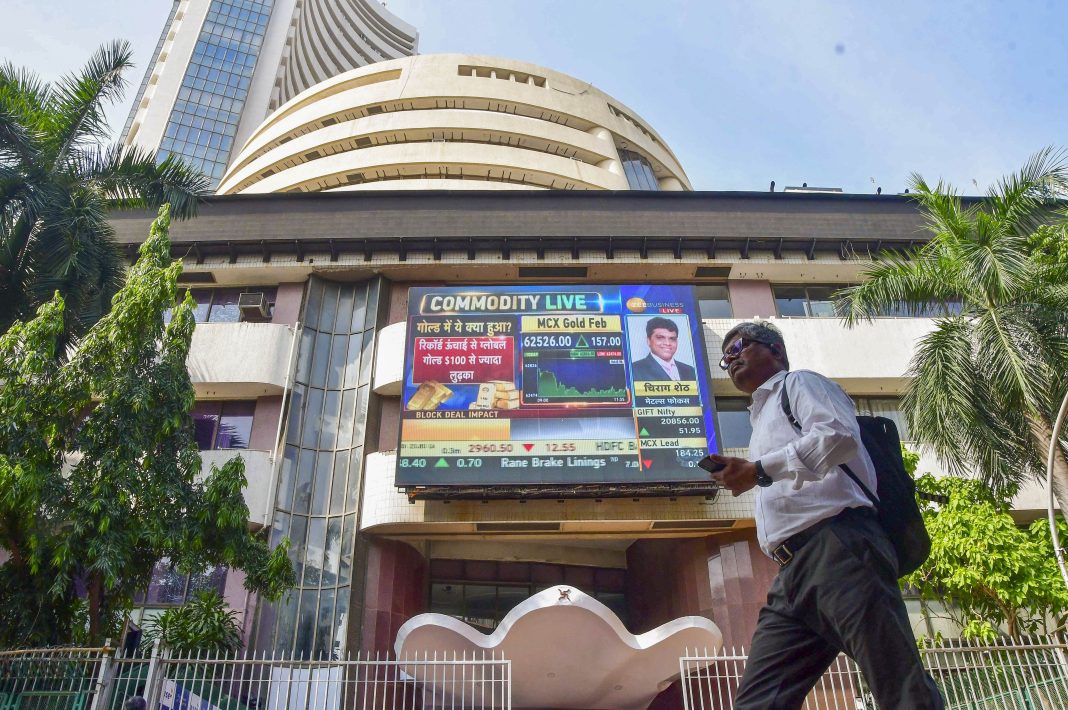

Mumbai, Apr 30: Equity benchmark indices Sensex and Nifty stayed range-bound for the second consecutive session and ended flat on Wednesday in a highly volatile trade amid escalated geopolitical tensions and selling in Bajaj twins.

Sustained foreign fund inflows, however, restricted the markets decline.

The 30-share BSE benchmark gauge declined 46.14 points or 0.06 per cent to settle at 80,242.24. During the day, it hit a high of 80,525.61 and a low of 79,879.15, gyrating 646.46 points.

The NSE Nifty ended marginally lower by 1.75 points or 0.01 per cent at 24,334.20.

“Nifty extended its consolidation for the second consecutive session, closing flat ahead of key US economic data (Q1 GDP) today. Market sentiment remains cautious due to the ongoing India-Pakistan geopolitical concerns,” said Siddhartha Khemka, Head – Research, Wealth Management, Motilal Oswal Financial Services Ltd.

From the Sensex firms, Bajaj Finserv dropped over 5 per cent, while Bajaj Finance tanked almost 5 per cent each.

Bajaj Finserv Ltd (BFL) on Tuesday reported a 14 per cent increase in consolidated net profit to Rs 2,417 crore in the fourth quarter ended March 2025.

Meanwhile, NBFC firm Bajaj Finance on Tuesday reported a 16 per cent rise in standalone net profit to Rs 3,940 crore in the March 2025 quarter.

Tata Motors, State Bank of India, UltraTech Cement, Tata Consultancy Services, Tata Steel and Asian Paints were among the other laggards from the 30-share pack.

Maruti, Bharti Airtel, Power Grid, Hindustan Unilever and HDFC Bank were among the gainers.

The BSE smallcap gauge tanked 1.74 per cent and midcap index declined by 0.72 per cent.

“Benchmark indices closed largely flat for the second straight session on Wednesday in a range-bound market. However, broader mid and smallcap indices closed sharply lower for the day. Markets traded in a narrow range, digesting earnings announcements. There are no clear or strong signals from the macro side to push the markets decisively in either direction. While trade deal optimism persisted, the border situation remained tense,” Satish Chandra Aluri, Analyst, Lemonn Markets Desk, said.

Among sectoral indices, industrials dropped 1.20 per cent, services (1.10 per cent), commodities (0.93 per cent), power (0.89 per cent), utilities (0.88 per cent) and financial services (0.72 per cent).

Telecommunication, auto, realty and teck were the gainers.

In Asian markets, South Korea’s Kospi index and Shanghai SSE Composite settled lower while Tokyo’s Nikkei 225 and Hong Kong’s Hang Seng ended higher.

Markets in Europe were quoting higher.

US markets ended in the positive territory on Tuesday.

Foreign Institutional Investors (FIIs) bought equities worth Rs 2,385.61 crore on Tuesday, according to exchange data.

Global oil benchmark Brent crude declined 0.92 per cent to USD 63.66 a barrel.

The BSE benchmark climbed 70.01 points or 0.09 per cent to settle at 80,288.38 on Tuesday. The Nifty ended marginally up by 7.45 points or 0.03 per cent to 24,335.95. Both the indices gained more than 1 per cent in the preceding session on Monday.

“The broad market performed well this month, driven by reduced tariff risks, a potential US-India trade deal, and strong FII inflows. However, momentum is being capped by rising tensions between India and Pakistan and muted Q4 results. This negative bias is expected to persist in the near term, but the long-term outlook remains positive due to the minimal financial impact from the conflict. Consequently, any market consolidation is likely to be used as an investment opportunity,” Vinod Nair, Head of Research, Geojit Investments Limited, said.

Equity markets will remain closed on Thursday for ‘Maharashtra Day’. (PTI)