By Satyabrat Borah

Social media has become an integral part of modern life, shaping how we connect, learn, and make decisions. Among its many influences, one of the most concerning is its impact on personal finances, particularly through the rise of financial influencers, commonly known as influencers. These individuals, often with massive followings on platforms like YouTube, Instagram, and TikTok, dispense investment advice that can lead to significant financial harm. Influencers have emerged as a genuine menace in the financial landscape. Allowing them to operate without stringent oversight is no longer viable. Tough regulation is essential to protect vulnerable investors from misleading and often reckless guidance.

To understand the scale of the problem, consider some stark figures from India. This year, revisions to tax slabs have effectively increased collective disposable income by approximately one lakh crore rupees, putting more money in people’s pockets. Yet, just last year, ninety-three percent of retail traders in the futures and options segment collectively lost around seventy-five thousand crore rupees. These numbers, when viewed side by side, highlight the devastating consequences of poor financial decisions driven by bad advice. When small investors lose thousands of crores from their hard-earned savings or even borrowed funds, it does not just affect individuals. It weakens consumer demand, which remains India’s primary economic growth driver. Protecting investors, especially those with limited resources, from being misled is therefore a matter of national interest.

The markets regulator, the Securities and Exchange Board of India (SEBI), recently took welcome action against a prominent finfluencer accused of earning over five hundred forty-six crore rupees through questionable practices. The regulator barred him from the markets and seized his illicit gains. This move signals a growing recognition of the dangers posed by unregulated financial advice on social media. However, such isolated actions are insufficient. A deeper and more comprehensive cleanup is urgently required for several compelling reasons.

First, the potential for widespread harm is simply too great to adopt a hands-off approach. This view aligns with an evolving global consensus on the need for intervention. The core issue lies in the incentive structure of finfluencers. They are primarily content creators whose success depends on attracting and retaining eyeballs. Dispensing cautious, long-term investment advice, such as recommending diversified mutual funds or fixed deposits, rarely generates viral engagement. Instead, the fastest path to growing an audience involves promoting high-risk, get-rich-quick opportunities like cryptocurrencies or derivatives trading in the futures and options market. These topics create excitement, promise quick profits, and drive views, likes, and shares, which in turn boost algorithmic visibility and monetization.

Traditional financial advisors operate under a different model. They are typically registered, bound by fiduciary duties, and required to assess a client’s risk profile, financial goals, and capacity before offering personalized recommendations. Finfluencers, by contrast, broadcast generic advice to millions without knowing anything about their followers’ circumstances. They have no insight into whether a viewer is a young professional with disposable income or a retiree relying on limited savings. This detachment makes it easier to promote speculative schemes without regard for the consequences. Pump-and-dump operations, where influencers hype an asset to inflate its price before selling off their holdings, thrive in this environment. Followers rush in at peak prices, only to suffer heavy losses when the inevitable crash occurs.

International examples abound and serve as cautionary tales. Four years ago, celebrity Kim Kardashian promoted a cryptocurrency called Ethereum Max on her Instagram account to her hundreds of millions of followers. The token’s value plummeted by ninety-seven percent within months, wiping out investors who followed her endorsement. Regulators in the United States fined her for failing to disclose that she was paid for the promotion. Another notorious case involved the electric vehicle company Nikola. Around five years ago, numerous influencers and promoters drove its stock price to extraordinary heights based on exaggerated claims about its technology. Reality soon caught up, revealing significant misrepresentation. The company’s shares collapsed, and today they trade at a fraction of their peak, effectively worthless for many who bought in during the frenzy. These incidents illustrate how influential figures can cause massive financial damage, often with impunity if regulations are lax.

Surveys conducted abroad reveal troubling trends among younger generations. Approximately forty percent of Gen-Z individuals reportedly base their investment decisions entirely on advice gleaned from social media. In India, SEBI’s own studies indicate that sixty-two percent of retail investors rely completely on finfluencers for guidance. This level of dependence is deeply unhealthy. Part of the problem stems from widespread financial illiteracy, where people lack the tools to evaluate advice critically. However, the sheer size of these influencers’ audiences, often numbering in the millions, fosters a dangerous suspension of disbelief. Followers assume that popularity equates to expertise and trustworthiness. Lavish displays of wealth, luxury cars, and opulent lifestyles portrayed in videos reinforce the illusion that these individuals have unlocked secrets to financial success, secrets they are generously sharing.

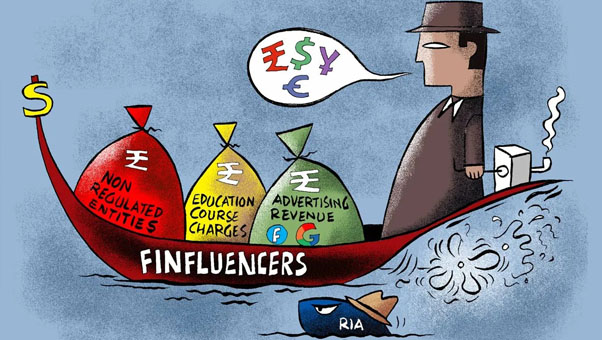

In reality, many finfluencers profit not from their investment acumen but from their followers. Revenue streams include referral fees from trading platforms, commissions from promoted products, paid courses promising trading mastery, and sponsorships. When followers act on hyped recommendations, the influencer benefits regardless of the outcome. If the trade succeeds, they claim credit. If it fails, they blame market volatility or the follower’s execution, rarely accepting responsibility. This asymmetry encourages reckless promotion of high-risk instruments that offer the allure of quick gains but carry a high probability of loss.

India’s youth are particularly vulnerable. Facing job uncertainty, rising living costs, and pressure to achieve financial independence quickly, many are drawn to narratives of overnight success. Finfluencers exploit this aspiration by showcasing curated success stories while downplaying risks. New investors, enticed by promises of multiplying their money, pour in funds they can ill afford to lose. Many borrow money or dip into emergency savings, only to face ruin when markets turn. The futures and options segment, heavily promoted for its leverage, has become a graveyard for retail traders, with the vast majority incurring losses as evidenced by recent data.

The need for regulatory intervention is clear and multifaceted. When the scale of potential harm is so immense, a laissez-faire attitude is indefensible. The misaligned incentives of content creators prioritize engagement over prudence. The lack of personal accountability allows advice to be dispensed without empathy or due diligence. Global regulators are responding accordingly. In the United States, the Securities and Exchange Commission has pursued cases against celebrities and influencers for undisclosed paid promotions. In the United Kingdom, the Financial Conduct Authority requires clear disclosures and has banned certain high-risk product promotions to retail investors altogether.

In India, SEBI has introduced measures requiring finfluencers to partner only with registered advisors and prohibiting unregistered entities from offering specific investment recommendations. The recent high-profile enforcement action demonstrates willingness to impose severe penalties, including market bans and asset seizures. Yet gaps remain. Many influencers continue operating in gray areas, using vague language to skirt rules or shifting to unregulated assets like cryptocurrencies. Stronger enforcement mechanisms, mandatory disclosures for any financial promotion, real-time monitoring of social media content, and steeper penalties for violations are needed to deter misconduct effectively.

Beyond regulation, enhancing financial literacy is crucial. Educational initiatives in schools and colleges should cover personal finance basics, risk management, and critical evaluation of online information. Public awareness campaigns can highlight the dangers of unsolicited advice and promote verified sources. Individuals must learn that sustainable wealth building requires patience, diversification, and informed decision-making, not chasing speculative trends.

Ultimately, curbing the excesses of finfluencers is not merely about protecting individual savings. It has broader economic implications. When households retain and grow their wealth confidently, they spend more on goods and services, fueling consumption-led growth. Losses from misguided investments, conversely, erode confidence and constrain spending. By fostering a safer investment environment, regulators can help channel household savings into productive avenues that support long-term economic stability.

Social media platforms themselves bear responsibility. Algorithms that amplify sensational content should be adjusted to deprioritize unverified financial claims. Collaboration with regulators to flag suspicious promotions could prevent harm at scale. Investors, too, must exercise caution. Seeking advice from qualified professionals, verifying credentials, and resisting the allure of quick riches are essential habits.

The harm inflicted by unregulated finfluencers extends far beyond individual portfolios. It undermines financial security, exploits vulnerability, and hampers national economic potential. While recent regulatory actions are encouraging, they represent only the beginning. Comprehensive reforms, combining tough oversight, public education, and platform accountability, are indispensable. Only through concerted effort can we ensure that social media serves as a tool for empowerment rather than exploitation in matters of personal finance. Protecting investors today will yield dividends for generations tomorrow.