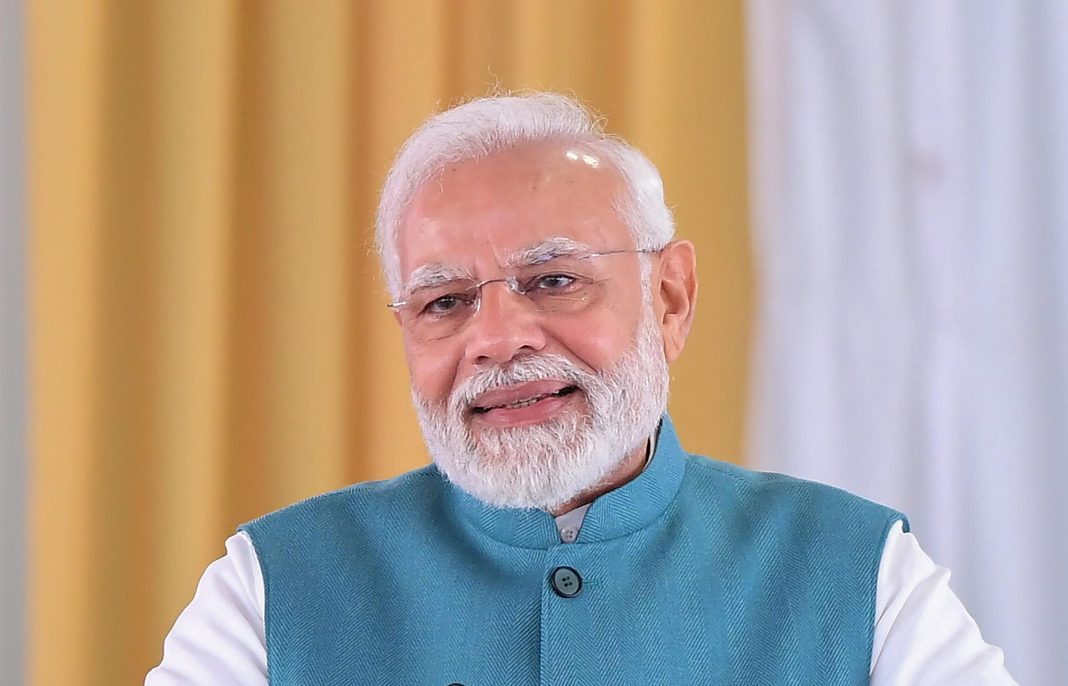

New Delhi, Sept 22: Prime Minister Narendra Modi on Monday said the next generation GST reforms will boost savings and directly benefit every section of society, as he asserted that it is imperative to walk on the path of self-reliance to achieve the collective goal of Viksit Bharat by 2047.

In an open letter to Indians which he posted on X, Modi said that from September 22, next generation GST reforms have begun to make their presence felt, marking the start of a ‘GST Bachat Utsav’ or ‘GST Savings Festival’ across the country.

“This year, the festive season brings an added reason to rejoice. These reforms will boost savings and directly benefit every section of society, be it farmers, women, youth, poor, middle class, traders or MSMEs. They will encourage greater growth and investments and accelerate the progress of every state and region,” the prime minister said.

An important feature of the next generation GST reforms is that there will mainly be two slabs of 5 per cent and 18 per cent, he said.

“Daily essentials such as food, medicines, soap, toothpaste, insurance and many more items will now either be tax-free or fall in the lowest 5% tax slab. Goods that were earlier taxed at 12% have almost entirely shifted to 5%. It is greatly heartening to see various shopkeepers and traders putting up then and now boards which indicate taxes pre-reforms and post-reforms,” Modi said in his letter to the people.

In the last few years, 25 crore people have risen above poverty and formed an aspirational neo-middle class, he said.

“Further, we have also strengthened the hands of our middle class with the massive income tax cuts, which ensure zero tax up to the annual income of Rs 12 lakh. If we combine the income tax cuts and the Next Generation GST reforms, they add up to savings of nearly Rs 2.5 lakh crore for the people,” he said.

“Your household expenses will reduce and it will be easier to fulfil aspirations such as building a home, purchasing a vehicle, purchasing appliances, eating out or planning a family vacation,” the prime minister said.

Noting that the nation’s GST journey, which began in 2017, was a turning point in freeing citizens and businesses from the web of multiple taxes, Modi said the GST united the nation economically.

“‘One Nation, One Tax’ brought uniformity and relief. The GST Council, with the active participation of both Centre and states, took many pro-people decisions. Now, these new reforms take us further, simplifying the system, reducing rates and putting more savings in the hands of the people,” he said.

“Our small industries, shopkeepers, traders, entrepreneurs and MSMEs will also see greater Ease of Doing Business and Ease of Compliance. Lower taxes, lower prices and simpler rules will mean better sales, less compliance burden and growth of opportunities, especially in the MSME sector,” he said.

Asserting that collective goal is Viksit Bharat by 2047, Modi said to achieve it, walking on the path of self-reliance is imperative.

These reforms strengthen our local manufacturing base, paving the way towards Aatmanirbhar Bharat, he said.

“On a related note, this festive season, let us also resolve to support products that are Made in India. This means buying Swadeshi products that have the sweat and toil of an Indian involved in their making, irrespective of the brand or the company that makes them,” he said.

“Every time you buy a product made by our own artisans, workers and industries, you are helping many families earn their living and creating job opportunities for our youth,” Modi said.

He appealed to shopkeepers and traders to sell products that are Made in India.

“Let us proudly say – what we buy is Swadeshi. Let us proudly say – what we sell is Swadeshi,” the prime minister said.

“I also urge state governments to encourage industry, manufacturing and improvement of investment climate,” he said.

As the nation celebrates the beginning of Navaratri, Modi extended heartfelt wishes to the people.

Posting the letter on X, Modi said “This festive season, let’s celebrate the ‘GST Bachat Utsav’! Lower GST rates mean more savings for every household and greater ease for businesses.” (PTI)